Off topic comments, attacks or insults will not be tolerated. Follow reddiquette and keep discussions civil, informative and polite.You can also find the tutorials and help topics for YNAB 4, as well as download their previous apps on their Classic website.Īlso check out our wiki! Subreddit Guidelines Please wander over to some of the following links at YNAB's website: YNAB has a lot of really great support resources that you should probably check out. There is a YouTube playlist by YNAB which acts as a primer for nYNAB as well. Feel free to post your questions, budget strategies & advice.įor veteran users, learn more about the changes to the new rules in the Transition Guide. We welcome any posts here regarding YNAB.

This subreddit is dedicated to discussion on the popular budget software You Need A Budget. NYNAB was last updated 10 November 2021 Welcome to /r/YNAB

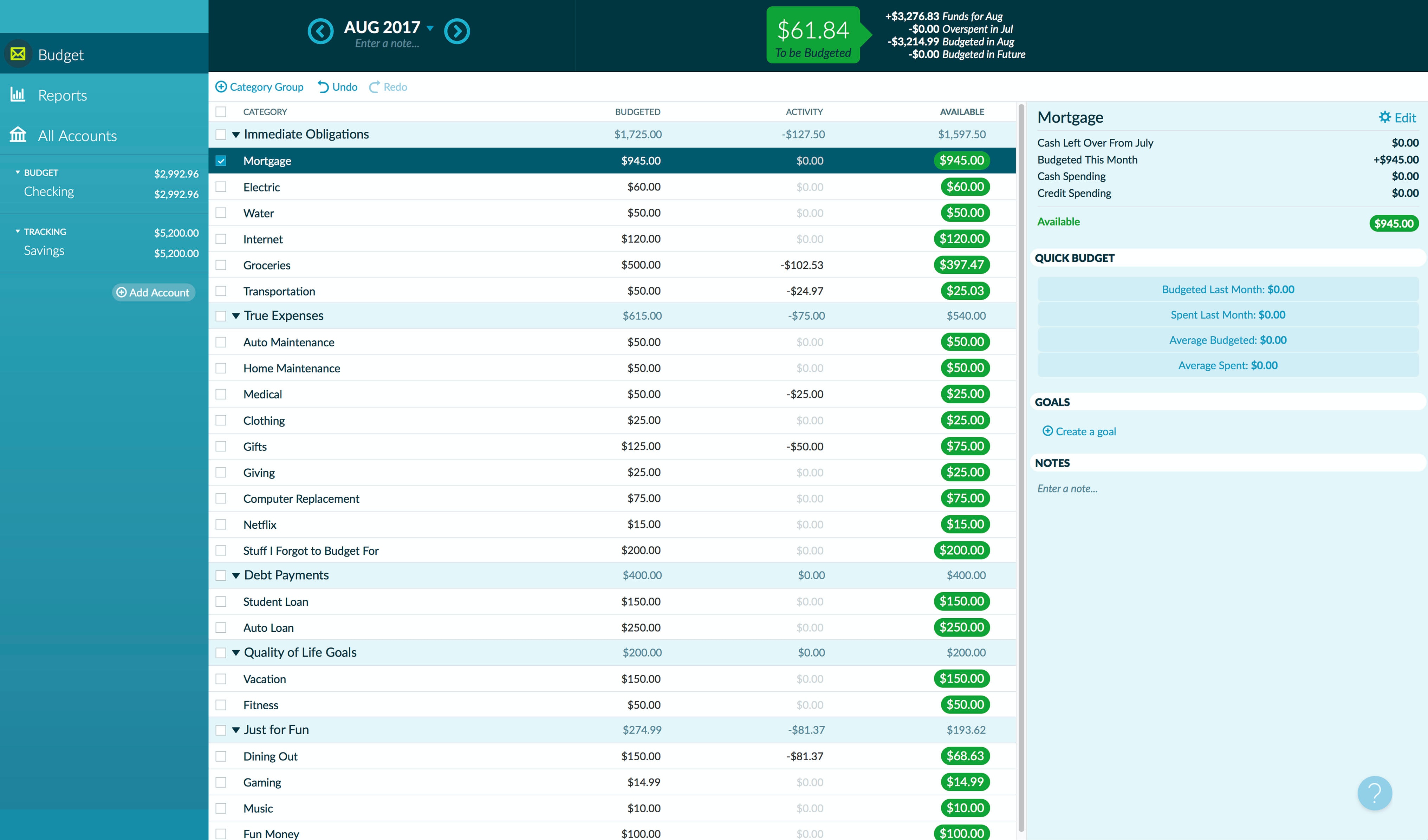

In either case, any inflow of money is tagged “to be budgeted” and from this sum you can allocate amounts to your spending and saving categories. You can choose to direct import transactions from your bank or enter them manually. YNAB makes it easy to live by these rules with its category-based interface. It’s a lofty goal, but as YNAB says it will keep you “living far, far away from the financial edge.” Ideally, you should shoot to live this month on last month’s income. YNAB allows you to be nimble and easily move money from a budgeted category to cover unbudgeted spending and stay out of the red.Ĥ) Age your money-Timing your bills with your paychecks is about as easy as aligning the planets. YNAB lets you allocate every dollar in hand to specific spending and saving categories.ģ) Roll with the punches-No matter how well you plan, your budget will inevitably run head first into unforeseen expenses. YNAB proposes you budget for these expenses monthly to even out your cash flow over the year and avoid taking big budget hits during certain months. What typically derails a budget are the less frequent ones, like annual insurance premiums and subscriptions, birthdays and holidays, and your kids’ seasonal sports fees. 2) Embrace your true expenses-It’s easy to see your monthly bills coming.

0 kommentar(er)

0 kommentar(er)